Medical Devices: All You Need to Know

Medical devices are objects which are intended to be used for medical purposes1. They come in different shapes and sizes and can range from surgical instruments to implants, heart monitoring software to tongue depressors.

While classifications of medical devices by national health institutions can differ from each other, there are certain regulations manufacturers have to comply with in order to guarantee patient safety.

This article will provide an overview of what makes a medical device, the challenges involved in classifications of medical devices, and how automated solutions can help manufacturers reach compliance more easily while increasing production process safety and efficiency.

Definition of a medical device

The definition of what makes a medical device is rather broad. The World Health Organization (WHO) describes it as any type of device that is “intended by the manufacturer to be used, alone or in combination for a medical purpose”2. This definition includes medical articles, instruments, apparatuses and machines that are used for diagnosis and treatment of diseases and illnesses3.

As the classifications for medical devices are set by the different national regulatory healthcare institutions, it is difficult to establish a distinct global definition.

Main types of medical devices

There are different categories of medical devices that can be distinguished. These are, for example, single use devices, implantables, imaging, medical equipment, software and mobile medical apps, in vitro diagnostic medical devices, personal protective equipment and surgical instruments4.

Which regulatory requirements apply to a medical device adheres to the risk it poses to the human body. Therefore, the different national health authorities put them in different risk categories to provide guidance for manufacturers.

Examples of medical devices

What is considered a medical device, is defined by national public health organizations. This is why definitions, as well as regulations for producers and providers, may vary from region to region. While national health systems orient themselves on WHO standards for draft guidance documents, the European Medicines Agency sets regulations for EU member states, for instance. While the Food and Drug Administration operates in the U.S., Health Canada sets guidelines for the Canadian state.

Despite initiatives like the International Medical Devices Regulators Forum (IMDRF), no global harmonization for the classification of medical devices exists, we will provide examples as defined by the regulatory framework of the U.S. Food and Drug Administration (FDA).

The FDA distinguishes three classes of medical devices by their risk factor and the necessary regulatory requirements that have to be taken in order to guarantee product quality and patient safety. This includes guidance documents on product development, quality systems for manufacturing processes, control systems, and clinical trials.

Class I: This class includes low risk medical products like tongue depressors, toothbrushes, or bandages. Class I devices are only subject to basic regulatory requirements because they are not intended to be used in the support or sustaining of life and do not represent health risks for humans5.

Class II: Class II includes medium risk health technology and equipment that require special controls. Examples are acupuncture needles, syringes, autoinjector pens, powered wheelchairs, catheters, infusion pumps, air purifiers, medical ventilators, or surgical robots6.

General controls are considered sufficient for Class I devices, but as Class II devices require a higher level of controls to assure their safety and effectiveness, they are treated differently.

Special controls include, among others, performance standards, postmarket surveillance, special labeling requirements or premarket data requirements7.

Class III: Medical devices listed in Class III are considered high risk by the FDA. They require premarket approval to ensure patient safety as they are usually used to support or sustain human life. Examples include implants like pacemakers, defibrillators, glucose monitors or pulse generators. In cases of medical devices that have contact with sterile body tissues like implants or surgery items that enter the human body, special precautions have to be taken in terms of sterility8.

Top medical device manufacturer

The market for medical devices has experienced constant growth in the past years and is listed with US $511.20bn global revenue for 2024, which makes a 6.6% increase compared to the previous year9.

There are several new companies entering the market, however there are established key players whose revenues make up the main share of market income.

Some honourable mentions from the list of the most successful distributors of medical devices are Medtronic, Johnson & Johnson, and Roche.

With a $32.32 billion annual revenue in 202310, Medtronic is one of the most economically vital firms that specializes in medical devices. The U.S. based company was the first to release a battery operated pacemaker, developed mechanical heart valves and implantable cardioverter defibrillators. They concentrate on the improvement of human health conditions through medical technology.

Johnson and Johnson’s Medtech division, which concentrates on the development and production of medical devices, accounted for 36 per cent of their annual revenue in 2023 with 27.4 billion11. The company with headquarters in Japan, Germany and several other countries, provides everything from bandages, to catheters, implants and robotic assisted technology for medical manufacturing.

Roche is the only one of the companies in our selection that is based in Switzerland. In 2023, the company generated 58.7 billion Swiss francs annual revenue. Roche’s main focus lies on two areas: diagnostics and pharmaceuticals. Products include PCR tests, laboratory equipment and medical equipment like syringes and drug delivery systems like autoinjectors.

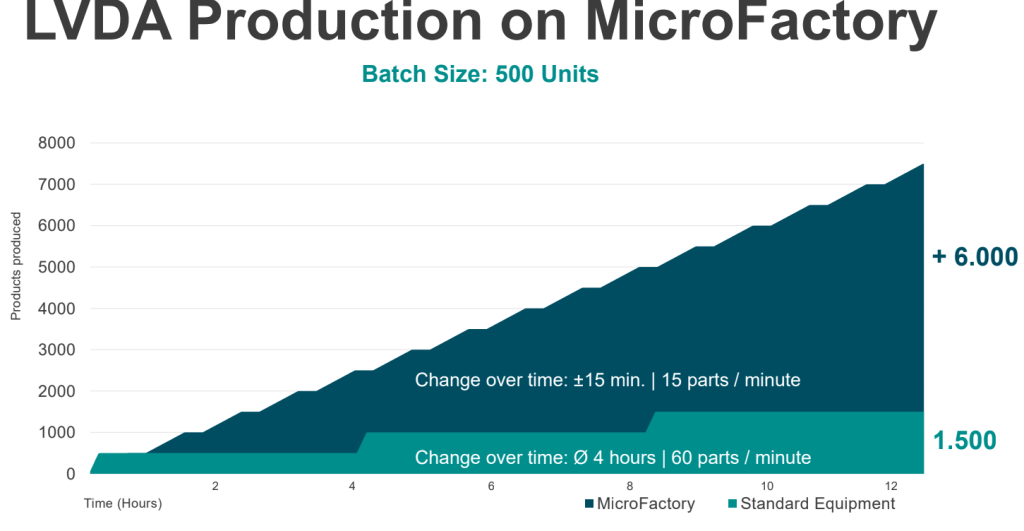

As Roche was on the lookout for innovative and flexible production methods, they decided to collaborate with ESSERT Robotics. By setting up an ESSERT MicroFactory suitable for syringe and autoinjector assembly, Roche was able to optimize production times in comparison to fixed, non-modular automation solutions, which often have exhaustive changeover times especially in the production of small batch sizes – a time when the production stands still. With the ESSERT MicroFactory, on the other hand, changeovers can be processed completely automated by the push of a button.

Medical Device Assembly: Future-proof solutions

Although biopharma is known to be one of those industries which have been rather slow to integrate automation12 in manufacturing processes, changes in demographics and an increasing risk for geopolitical crises are likely to change that soon.

The shortage of qualified workers is not only an issue for pharmaceutical manufacturing companies, but also palpable for medical device producers13. Automated solutions can help to fill this gap in workforce and overall streamline the manufacturing process with less off-times and less risk for human errors, which is especially high in monotonous tasks like device assembly.

Another risk factor for medical device productions are regional crises that can lead to factory standstills and bottlenecks. Decentralizing the production of medical devices and moving them to more localized, automated facilities, can help to shield manufacturers from negative effects of geo- and sociopolitical changes.

Further, innovative automated solutions can help to react to changes in medical device market demands, which are moving towards a more personalized approach. Tailored solutions for individual patients are on the rise and High Mix / Low Volume productions a growing part of the medical device industry. As this calls for highly flexible solutions for the ever-changing requirements of the manufacturing process, modular GMP compliant technology like the ESSERT MicroFactory are here to support HMLV manufacturers in the challenges they have to face.

Medical Device Assembly with the ESSERT MicroFactory

The future of the medical device industry, especially for HMLV manufacturers, might bear its challenges. However, with the help of automation, exciting new advancements for personalized medicine can be achieved.

Responding to the trend towards smaller volumes and more configurations requires more modular and flexible production solutions. ESSERT has developed a flexible, modular and scalable production line – the MicroFactory.

The innovative modular system architecture allows easy adaptation to a wide range of medical products, such as prefilled syringes or autoinjectors, with minimal complexity and no format parts, while ensuring high OEE through fast changeover times.

- “Medical devices”. World Health Organization. DOI: https://www.who.int/health-topics/medical-devices. Accessed 20 March 2024. ↩︎

- “Medical devices”. World Health Organization. DOI: https://www.who.int/health-topics/medical-devices#tab=tab_1. Accessed: 18 March 2024. ↩︎

- “Health products policy and standards”. World Health Organization. DOI: https://www.who.int/teams/health-product-policy-and-standards/assistive-and-medical-technology/medical-devices. Accessed: 18 March 2024. ↩︎

- “Nomenclature of medical devices”. World Health Organization. DOI: https://www.who.int/teams/health-product-policy-and-standards/assistive-and-medical-technology/medical-devices/nomenclature. Accessed: 19 March 2024. ↩︎

- “General controls for medical devices”. Food and Drug Administration. DOI: https://www.fda.gov/medical-devices/regulatory-controls/general-controls-medical-devices. Accessed: 19 March 2024. ↩︎

- “Regulatory controls”. Food and Drug Administration. DOI: https://www.fda.gov/medical-devices/overview-device-regulation/regulatory-controls. Accessed: 19 March 2024. ↩︎

- “Regulatory controls”. Food and Drug Administration. DOI: https://www.fda.gov/medical-devices/overview-device-regulation/regulatory-controls. Accessed: 19 March 2024. ↩︎

- “Sterilization”. Centers for Disease Control and Prevention. DOI: https://www.cdc.gov/infectioncontrol/guidelines/disinfection/sterilization/index.html. Accessed: 19 March 2024 ↩︎

- “Medical devices – worldwide”. Statista. DOI: https://www.statista.com/outlook/hmo/medical-technology/medical-devices/worldwide. Accessed: 19 March 2024. ↩︎

- “Medtronic reports third quarter fiscal 2024 financial results”. Medtronic. DOI: https://news.medtronic.com/2024-02-20-Medtronic-reports-third-quarter-fiscal-2024-financial-results. Accessed: 20 March 2024. ↩︎

- “Sales of Johnson & Johnson’s medical technology segment from 2021 to 2023, by franchise”. Statista. DOI: https://www.statista.com/statistics/266406/revenue-of-johnson-und-johnsons-medical-devices-and-diagnostics-segment/. Accessed 20 March 2024. ↩︎

- Holland I, Davies JA. Automation in the Life Science Research Laboratory. Front Bioeng Biotechnol. 2020 Nov 13;8:571777. doi: 10.3389/fbioe.2020.571777. PMID: 33282848; PMCID: PMC7691657. ↩︎

- Ikhile I, Anderson C, McGrath S, Bridges S. Is the Global Pharmacy Workforce Issue All About Numbers? Am J Pharm Educ. 2018 Aug;82(6):6818. doi: 10.5688/ajpe6818. PMID: 30181678; PMCID: PMC6116881 ↩︎